Quarterly Market Review: April–June 2025

Buckle Up - Q2 Was a Bumpy but Surprisingly Rewarding Ride

If the second quarter had a soundtrack, it’d be part suspense thriller, part comeback anthem. With global trade tensions, Middle East unrest, and market swings, investors had plenty to track. Still, markets shook it off and ended June strong, offering a welcome dose of optimism.

Markets Shake Off April Blues

Q2 started with a dip as new tariffs and geopolitical concerns triggered investor anxiety. But a 90-day de-escalation period in May brought a sharp rally. By quarter’s end, the S&P 500 had bounced back, and the NASDAQ surged thanks to AI and digital stock strength. The Dow and Russell 2000 also ended higher. Sector-wise, tech and communication services soared, while energy, health care, and real estate lagged. Bonds remained volatile amid inflation concerns and shifting global policies.

Inflation, the Fed, and the Labor Market

Although tariffs didn’t push inflation as high as feared, consumer prices stayed elevated. The CPI and PCE indexes ticked lower but remained above the Fed’s 2% goal. The Fed held interest rates steady while watching for signs of slowdown. Unemployment crept up to 4.2%, w ith job growth softening and benefit claims rising. Still, corporate earnings were mostly favorable, keeping hopes for continued growth alive.

Economic Growth and Housing

After a 0.5% Q1 GDP contraction, driven in part by a surge in imports, the economy was expected to rebound modestly in Q2. However, full-year growth is projected to slow compared to past years. In housing, prices continued climbing, inventory improved, and mortgage rates stayed elevated but eased slightly, averaging 6.81% for a 30-year fixed loan in June.

Gold Glows, Oil Wavers

Gold had its best quarter since 1986, topping $3,400/oz as investors sought safety. Crude oil prices dipped early on oversupply concerns but rebounded later due to rising geopolitical tensions. Gas prices rose modestly to $3.213/gallon, up slightly from a month earlier but still below 2024 levels.

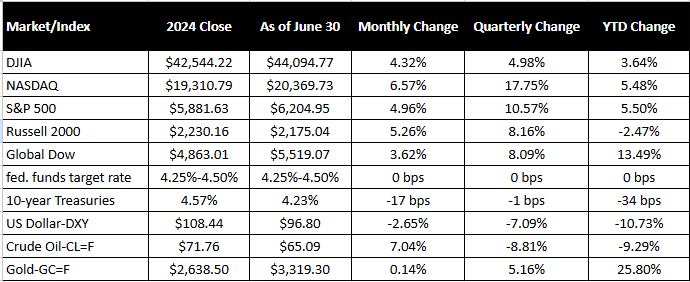

Stock Market Indexes

Looking Ahead to 2025

We will continue to monitor economic developments and keep you updated on key trends and opportunities. If you have questions or would like to discuss how these market movements may impact your financial plan, we are here for you.

Your Financial Focus Team

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources ( i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 largest, publicly traded companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indexes listed are unmanaged and are not available for direct investment.