Yes, Ladies and gentlemen, we are in an election year and we’ll talk more about that later. But first, let’s review the year we’re in so far.

The first quarter of 2024 found Wall Street off and running. Even though January saw stocks get off to a slow start as investors took some gains, particularly from tech shares, investors found encouragement in the strengthening of the economy, the likelihood of interest rate cuts ~ possibly as soon as June ~ and the seemingly endless opportunities in artificial intelligence.

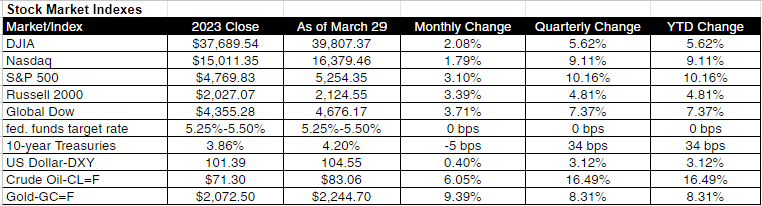

Each of the benchmark indexes below posted solid first-quarter gains led by the S&P 500 and the Nasdaq. Many of the indexes reached new highs throughout the quarter. Of note is that the S&P 500 hit its first record high in two years late in January, leading to its best first-quarter performance since 2019. The Federal Reserve provided encouraging news following its meeting in March as it projected three interest rate cuts by the end of the year! That also helped fuel the rise in the markets. Ten-year Treasury yields stayed around 4.2% for most of the quarter, up from 3.86% at the close of 2023.

Roughly 76% of S&P 500 companies reported fourth-quarter corporate earnings that exceeded analysts' expectations. Though some of the "Magnificent Seven" mega cap stocks stumbled a bit in the first quarter, nevertheless they were still responsible for nearly 40% of the S&P 500's year-to-date gain, though down from over 60% of the gain in 2023. Remarkably, ten of the 11 market sectors posted quarterly gains, with industrials, information technology, communication services, financials, and energy climbing more than 10%.

The U.S. dollar underwent several ups and downs, ultimately closing the first quarter higher and gold prices advanced to reach record highs. Crude oil prices, which began the year at about $71 per barrel, climbed nearly 16% to over $82 per barrel as oil exporting countries cut back on supplies. The retail price for regular gasoline was $3.523 per gallon on March 25, $0.027 above the February 26 price and $0.407 higher than the price three months earlier. Regular retail gas prices increased $0.102 from a year ago.

Home mortgage rates began the year at about 6.62% for the 30-year fixed rate, according to Freddie Mac. Rates jumped as high as 6.94% at the end of February, before falling to 6.79% at the end of March.

As investors took gains in January, they moved into sectors that lagged in 2023, including consumer staples, health care, and energy. By the end of the month, each of the benchmark indexes listed below posted gains, except for the Russell 2000. Inflation data showed prices inched higher, with the Consumer Price Index (CPI) and the personal consumption expenditures (PCE) price index increasing. The Federal Reserve met in January and maintained the federal funds target rate range at 5.25% to 5.50%.

The economy showed resiliency in January, despite the ongoing war in Ukraine and the turmoil in the Middle East. Gross domestic product rose 3.2%, while personal consumption expenditures rose 3%. Remembering that consumers are the largest driver of the US economy, their spending patterns have a large impact on overall economic activity. Job growth remained steady, while industrial production inched higher. All 11 market sectors ended January higher, led by industrials and materials. Bond returns were slightly negative, with yields on 10-year Treasuries inching up 10 basis points.

A bit more about the “off and running …..” Large-cap stocks advanced for the fourth consecutive month in February. Several of the benchmark indexes reached record highs, with the S&P 500 off to its strongest start since 2019. Value stocks and small caps also enjoyed a favorable month. Among the benchmark indexes, not surprisingly the Nasdaq and the Russell 2000 led the way. In contrast, bond values dipped lower, pushing yields up.

The economy continued to expand, despite operating in the highest interest-rate environment in nearly 20 years. The CPI and PCE price index climbed higher as inflationary pressures continued to prove quite stubborn. Retail sales dropped 0.8%, pulled lower by declines in sales for motor vehicles and parts and gasoline stations. On the brighter side, job gains were robust, adding more than 300,000 new jobs.

March continued the bull run for stocks. Each of the benchmark indexes below advanced, with the Global Dow, the Russell 2000, and the S&P 500 each gaining over 3%. Utilities, financials, materials, and energy led the market sectors in March.

Consumer spending and gross domestic product expanded in March. Inflationary pressures continued to increase as the Consumer Price Index rose 0.4% for the month and 3.2% for the year. Producer prices rose 0.6%, more than double most analysts' expectations. Overall, price pressures remained firmer than expected. Crude oil prices rose nearly 6%, while prices at the pump increased by about $0.274 for a gallon of regular gasoline.

Corporate earnings have a significant influence on the stock market as they ultimately drive stock prices. The value of securities is the present value of all future cash flows. Companies either reinvest earnings or pay them out to shareholders as dividends, which directly impact the stock price. As future expectations increase, future projections of company earnings will also increase.

The chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Latest Economic Reports

Employment: Total employment increased by 275,000 in February following a downwardly revised January total of 229,000 new jobs. Employment trended up in health care, government, food services and drinking places, social assistance, and transportation and warehousing. Over the 12 months ended in February, employment increased by an average of 230,000 per month. In February, the unemployment rate rose by 0.2 percentage point to 3.9%. The number of unemployed persons rose by 334,000 to 6.5 million, which was nearly 500,000 above the February 2023 figure.

FOMC/interest rates: The Federal Open Market Committee made no change to the federal funds target rate range following its meeting in March. The Committee decided to maintain interest rates at their current level primarily because inflation, while showing signs of general easing, remained elevated. The Fed continued to forecast three interest rate reductions in 2024, although that could change based on the course of inflation and the economy.

GDP/budget: The economy, as measured by gross domestic product, accelerated at an annualized rate of 3.4% in the fourth quarter of 2023 according to the third and final estimate from the Bureau of Economic Analysis and GDP increased 4.9% in the third quarter. Compared to the third quarter, personal consumption expenditures rose from 3.1% to 3.3%.

Deficit: February saw the federal budget deficit come in at $296 billion, well above the $22 billion from the January deficit. Through the first five months of fiscal year 2024, the total deficit sits at $828 billion, roughly $105 billion higher than the first five months of the previous fiscal year. So far in fiscal year 2024, total government receipts were $1.9 trillion ($1.7 trillion in 2023), while government outlays were $2.7 trillion through the first five months of fiscal year 2024, compared to $2.5 trillion over the same period in the previous fiscal year.

Inflation/consumer spending: According to the latest personal income and outlays report, personal income rose 0.3% in February (1% in January), while disposable personal income increased 0.2% in February, down from 0.4% in January. Excluding food and energy (core prices and a big part of a consumer’s budget), consumer prices rose 0.3% in February, down from January's 0.5% increase. Consumer prices have risen 2.5% since February 2023, 0.1 percentage point more than the advance for the 12 months ended in January. Core prices increased 2.8% over the same period.

Prices for shelter, up 0.4%, continued to rise in February, as did gasoline prices (3.8%). Combined, these two indexes contributed to over 60% of the monthly all items increase. Food prices were unchanged in February. Over the last 12 months ended in February, food prices rose 2.2%, shelter prices increased 5.7%, while energy prices fell 1.9%.

Housing: Sales of existing homes rose 9.5% in February from January. (This is likely only of interest to you if you have real estate some place other than California.) The median existing-home price was $384,500 in February, up from the January price of $378,600 and well above the February 2023 price of $363,600. The unsold inventory of existing homes represented a 2.9-month supply. Sales of existing single-family homes increased 10.3% in February but declined 2.7% for the year.

The median existing single-family home price was $388,700 in February, up from $382,900 in January and above the February 2023 price of $368,100. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.74% as of March 14, down from 6.88% the previous week and from 6.60% one year ago.

New single-family home sales decreased in February after increasing in December and January. Sales of new single-family homes fell 0.3% in February. Nevertheless, sales were up 5.9% from February 2023. The median sales price of new single-family houses sold in February was $400,500 ($414,900 in January). The February average sales price was $485,000 ($523,400 in January). The inventory of new single-family homes for sale in February represented a supply of 8.4 months at the current sales pace, down from 9.3 months in January.

International markets: The United Kingdom appears headed for a period of consumer-led economic growth. Falling inflation and rising purchasing power have increased hopes of a further economic rebound in the U.K. European countries may be heading to an interest rate decrease – a good thing. While the Bank of England held rates in March, Switzerland became the first European country to cut rates. China's industrial profits expanded to start the year, offering further evidence that the Chinese economy may be stronger than some suggested. For March, the STOXX Europe 600 Index rose 3.8%; the United Kingdom's FTSE gained 4.5%; Japan's Nikkei 225 Index gained 2.6%; and China's Shanghai Composite Index dipped 0.2%.

Consumer confidence: Consumer confidence was little changed in March from February. The Conference Board Consumer Confidence Index® was 104.7 in March, essentially unchanged from a downwardly revised 104.8 in February. The Present Situation Index, based on consumers' assessment of current business and labor market conditions, rose to 151.0 in March, up from 147.6 in the previous month.

Eye on the Quarter Ahead

The second, third and, sigh, part of the fourth quarter of 2024 will undoubtedly focus on election campaign rhetoric. “Also ran” will be corporate earnings, and the ongoing turmoil in Ukraine and the Middle East. Historically, US markets have risen in election years but what we know is that whenever a US presidential election rolls around, it's not uncommon to hear it described as "the most important" election year in our lifetime, if only to rally

To be sure, the political order can have sweeping impacts on policy and society. Given the intensity of feelings on both sides of the aisle, it’s natural for investors to assume the outcome could have a major impact on sentiment and prices in financial markets. But elections have often had less impact on markets than voters might assume, and history shows the challenges of trying to make investment decisions timed to an election year. Betting on specific policy or sector impacts can be highly risky.

While it’s possible to anticipate potential policy impacts at a very high level, the reality is that at this stage no one can predict with any certainty which party will win certain institutions, let alone what sectors, industries, or which stocks may benefit from the next administration’s policies.

As always, we will remain focused on your long-term goals and timelines. We will be watching for an interest rate reduction by the Federal Reserve, anticipated in June. It’s far too soon, if ever, to change course based on what may or may not happen during an election year.

Please call us with any questions or concerns you may have or if you would like to schedule an appointment.

A little humor for your day. “Why pay money to have your family tree traced; go into politics and your opponents will do it for you.” —Author Unknown

Your Financial Focus Team

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful. The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 largest, publicly traded companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indexes listed are unmanaged and are not available for direct investment.