1917 Palomar Oaks Way, Suite 130 - Carlsbad, CA - 92008

760.431.3040

“Nothing ventured, nothing gained,” is a proverb at least as old as the English language. But, without stepping out, trying your hand, and taking a chance, you may not achieve your goals – especially your financial goals. The goal, of course, is to make your money grow – keeping ahead of inflation, using interest rates to your advantage in saving and borrowing, riding through the ups and downs of the stock and bond markets and real estate cycles. What history tells us about the markets is that they fluctuate, sometimes wildly, and that it takes patience to win the day.

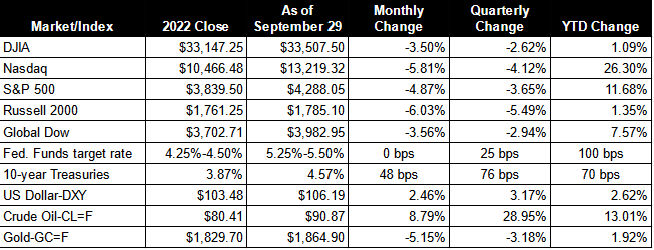

As much as we all would have liked, the positive momentum of the first two quarters of the year did not carry over to the third quarter. There are, of course, some very real reasons.

Inflation continued to prove stubborn throughout the third quarter, moderating somewhat, but not enough to curb the Federal Reserve's hawkish monetary policy. Crude oil and gas prices soared during the summer and are continuing to do so even into October. Job gains, while steady, declined throughout the third quarter. The housing sector slowed on rising mortgage rates and dwindling inventory. The third quarter saw most of the market sectors decline from the second quarter. Utilities, real estate, information technology, consumer staples, and consumer discretionary fell the furthest, while energy rose by more than 16%.

By the end of the quarter, each of the benchmark indexes had lost value compared to their second quarter performances. As you might expect, rising interest rates have impacted bond prices, yields, and the U.S. dollar. Ten-year Government bond yields rose in the third quarter, reaching the highest level since 2007, as long-term bond prices were lower. The U.S. dollar bounced back with a vengeance in the third quarter, hitting its highest level since November 2022.

The increase in the Federal Funds rate pushed mortgage rates to 7.31% on the benchmark 30-year home loan, the highest rate in 23 years. However, unlike 2000, home prices generally rise alongside mortgage rates, as demand has outpaced available inventory. It may be interesting to recall that the average 30-year mortgage rates started the decade of the 1980s at 12.85% then marched higher until they peaked at 18.63% in October 1981. Our point? We will survive.

Oil prices, near $91 per barrel, have risen nearly 30% since June, as Saudi Arabia and Russia, the world's second and third largest oil exporters, extended voluntary restrictions on their production. Gold prices declined in the third quarter, nearing a seven-month low.

July began the quarter with stocks posting notable gains from the previous month. Economic indicators offered signs that inflation was moderating, which helped equities advance. The S&P 500 notched its fifth consecutive monthly gain as all 11 market sectors finished the month higher. Despite slowing inflation, the Federal Reserve opted to hike interest rates by a quarter of a percent at the end of July. Go figure.

Along came August when stocks took a tumble. Each of the benchmark indexes listed here lost value, with the S&P 500 suffering a losing month for the first time since February. The Russell 2000 declined more than 5%, while the Nasdaq, the Dow, the Global Dow, and the S&P 500 slid more than 2%. Ten-year Treasury yields ended the month at 4.1%, up nearly 14 basis points from July.

So, here’s what happened. Investors seemed to view August's moderately favorable economic news as a sign that the Federal Reserve would maintain its aggressive monetary policy. The result was a move away from stocks. Except for energy, the remaining market sectors declined. Crude oil prices rose more than 2%, as production cuts from Saudi Arabia and Russia drove prices higher.

September continued the bear run for stocks. Each of the benchmark indexes listed fell between 3% and more than 6%. Inflationary pressures showed signs of cooling, with core prices for the CPI decreasing for the 12 months ended in August. The Federal Reserve elected not to increase interest rates in September, opting instead to step back and assess additional information and its implications for monetary policy. Gross domestic product advanced at an annualized rate of 2.1%, according to the third and final estimate. Crude oil prices continued to increase as did the yield on 10-year Treasuries. Gold prices declined more than 5%.

The chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Latest Economic Reports

Employment: Employment rose by 187,000 in August from July following a downwardly revised July total of 157,000. Over the last 12 months ending in August, the average monthly job gain was 312,000. In August, employment trended upward in health care, leisure and hospitality, social assistance, and construction. The unemployment rate increased 0.3 percentage point for the second straight month to 3.8%.

There were 204,000 initial claims for unemployment insurance for the week ending September 23, 2023. The total number of workers receiving unemployment insurance was 1,670,000.

FOMC/interest rates: The Federal Open Market Committee left the Federal Funds target rate unchanged following its meeting in September. However, it is anticipated that one more 25-basis point increase will occur before the end of the year. In addition, Fed Chair Jerome Powell indicated that inflation was still elevated and that interest rates would likely remain higher for a longer period than previously projected.

GDP/budget: Economic growth remained steady in the second quarter, as gross domestic product increased 2.1%, compared with a 2.2% increase in the first quarter. The deceleration in second-quarter GDP compared to the previous quarter primarily reflected a smaller decrease in consumer spending, a downturn in exports, and a deceleration in federal government spending.

The federal budget had a surplus of $89 billion in August but a deficit of $1,524 billion through the first 11 months of fiscal year 2023. By comparison, the August 2022 monthly deficit was $220.0 billion and the total deficit through August 2022 was $946 billion. In August, government receipts totaled $283 billion, while outlays equaled $194 billion. Compared to the first 11 months of the prior fiscal year, government outlays increased by $142.0 billion, while receipts rose by $438.0 billion.

Inflation/consumer spending: According to the latest Personal Income and Outlays report, consumer spending increased 0.4% in August, down from 0.9% (revised) in July. Personal income rose 0.4% in August, while disposable personal income inched up 0.2%. Rising prices at the pump pushed consumer prices higher in August. Over the 12 months ending in August, consumer prices increased 3.5%, 0.2 percentage points above the rate for the period ending in July.

The Consumer Price Index rose 0.6% in August compared to a 0.2% advance in July. Over the 12 months ending in August, the CPI advanced 3.7%, up half of one percent from the annual rate for the period ending in July. Energy prices rose 5.6% in August with gasoline prices increasing 10.6%, which accounted for over half of the overall CPI increase. Notably, energy prices are down 3.6% since August 2022 but food prices rose 4.3%.

Housing: Sales of existing homes decreased 0.7% in August, marking the third consecutive month of declines. Unsurprising to anyone, with the increase in mortgage rates since August 2022, existing-home sales dropped 15.3% and, according to the report from the National Association of Realtors®, limited inventory also took a toll.

In August, total existing-home inventory sat at a 3.3-month supply, unchanged from the previous month. The median existing-home price was $407,100 in August, up from the July price of $405,700 and well above the August 2022 price of $391,700.

Despite a drop in the number of sales, home prices continue to rise. Prices will likely remain elevated until inventory increases. Sales of existing single-family homes dropped 1.4% in August and 15.3% from a year ago. The median existing single-family home price was $413,500 in August, up from the July price of $411,200 and above the August 2022 price of $398,800.

Manufacturing: Industrial production advanced 0.4% in August after advancing 0.7% in July. Manufacturing inched up 0.1% in August, held back by a drop of 5.0% in the output of motor vehicles and parts.

Imports and exports: August saw both import and export prices increase for the second straight month. Import prices rose 0.5% following a 0.1% increase in July. The August increase in import prices was the third monthly advance of 2023. Imports declined 3.0% over the past year. Import fuel prices rose 6.7% in August, driven higher by production cuts.

The international trade in goods deficit decreased $6.6 billion, or 7.3%, in August. Exports of goods increased 2.2% from July, while imports of goods decreased 1.2%.

International markets: Russia's economy is expected to grow. Despite Western sanctions against Russia in response to the invasion of Ukraine, including a price cap on its oil exports, Moscow has apparently been able to offset that cap by increasing oil prices and exporting to new markets.

Elsewhere, after 14 consecutive monthly increases, the Bank of England decided to leave the Bank Rate at its current 5.25%, counter to the anticipated 25 basis point increase that was widely expected.

Price inflation remained steady in Japan as higher food and gasoline prices offset decreases in utilities. Japan's Consumer Price Index rose 2.8% for the 12 months ended in September.

China saw industrial profits fall 11.7% for the year ending in August, which was an upgrade from the 15.5% decline for the year ended in July. This is in line with China's industrial production, which rose 4.5% for the year ending in August, higher than the 3.7% estimate for the year ending in July. Overall, China saw its economy stall somewhat in September with retail sales, pricing power, and loan growth weaker compared to August.

Consumer confidence: Consumer confidence declined in September for the second straight month. The Conference Board Consumer Confidence Index® decreased in September to 103.0, down from 108.7 in August (revised). The Present Situation Index, based on consumers' assessment of current business and labor market conditions, rose marginally to 147.1 in September. The Expectations Index, based on consumers' short-term outlook for income, business, and labor market conditions, declined to 73.7 in September from 83.3 in August.

Eye on the Quarter Ahead

It appeared that the start of the fourth quarter might be marred by a government shutdown. However, U.S. lawmakers reached a short-term resolution right before the October 1 deadline. October has begun with autoworkers on strike and student loan payments resuming after a pandemic-related pause. Otherwise, investors will continue to focus on inflation data and the Federal Reserve's response during the last three months of the year. Concerns over slowing economic activity, both here and globally, will also influence the markets going forward.

Back to the basics for a moment. Investing for the future is always a game of chance and risk-taking is part of the game plan. All investing involves some element of risk and the types of investments you choose should generally be determined by your risk tolerance. The trick is to be a wise risk-taker and find the line for you between hopeful excitement and sleepless nights.

As always, we encourage you to call or schedule an appointment for any questions or concerns you may have. We’re here for you.

Your Financial Focus Team

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 largest, publicly traded companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange. The Russell 2000 is a market-cap weighted index composed of 2,000 U.S. small-cap common stocks. The Global Dow is an equally weighted index of 150 widely traded blue-chip common stocks worldwide. The U.S. Dollar Index is a geometrically weighted index of the value of the U.S. dollar relative to six foreign currencies. Market indexes listed are unmanaged and are not available for direct investment.