1917 Palomar Oaks Way, Suite 130 - Carlsbad, CA - 92008

760.431.3040

Every year toward year end we hear a lot of people talking about their “word” for the coming year. If ever there was a word needed for 2023, we think patience could be the best one. Investors have seen some of the most challenging issues since the early 90’s. Putting it simply, 2022 was a bust for the markets. Not pleasant times for anyone and, boy, don’t we know it.

The year 2022 may best be described by one word: inflation. The economies of the United States and the world were influenced by rising inflation, its causes, and the policies aimed at curtailing it. While inflationary pressures began to mount in 2021, they were exacerbated by continuing supply shortages, the ongoing effects of the COVID-19 pandemic, both here and abroad, the Russian invasion of Ukraine, and a global energy crisis. On a positive note, we did see some promising sigs in Q4 of inflation declining and growth potentially picking up.

Early in 2022, the Federal Reserve expected inflation to reach 2.6% by the end of the year, not much above their 2% target. Federal officials expected supply bottlenecks to ease, economies to re-open after relaxing COVID-related restrictions, and economic activity to return to something close to normal. As they say, the best laid plans of mice and men . . .

Unfortunately, the Fed underestimated how rising wages, federal aid, and expanded savings would lead to increased consumer spending, which continued to outpace supply, and drive prices higher. Most importantly, Fed officials didn't foresee the impact the Russian invasion of Ukraine would have on world trade in energy, food commodities, and resources such as natural gas and crude oil. Inflation was not just felt in the U.S. but throughout world economies as well. The International Monetary Fund expects worldwide inflation to hit 8.8%, the highest rate since 1996. In response, the Federal Reserve began the most aggressive policy of interest-rate hikes in more than 15 years.

Fed Chair Powell has spoken in the past few weeks and has reiterated that the Fed has a long way to go to bring inflation under control. Instead, the Fed is just merely slowing down the pace of Fed tightening. Economists often use automotive analogies to describe Fed actions. In this case, the Fed is just slowing the speed of the car from 75 mph to 50 mph, but it is still proceeding forward. Furthermore, the Fed has increased its previous forecasted peak in the federal funds rate (4.6%) to a higher level (5.1%). This means the exit ramp for the Fed will be pushed further down the highway.

Consumer price indexes in the 19 countries that use the euro currency rose to 10% or higher in November from a year earlier, while prices for food rose at a faster pace. The U.S. dollar surged in value against most world currencies, weakening foreign currencies and contributing to rising prices for goods and services.

While overall inflationary pressures may have peaked as we closed out 2022, food and energy prices remain elevated. Energy prices led the price surge at the beginning of the year. Crude oil prices rose to more than $110 per barrel for the first time since 2011. Energy prices, which were already rising at the end of 2021, were sent soaring following the Russian invasion of Ukraine as Russian refining capacity diminished amidst sanctions and trade restrictions imposed by several countries.

Just a little bit of a silver lining, we see that energy prices have since stabilized somewhat. Helping to stem surging oil prices was a notable retreat in Chinese energy demand amidst COVID-related restrictions, the stabilization of Russian crude output, increased U.S. oil production, and a release of oil from the Strategic Petroleum Reserve.

We won’t sugar coat it. The U.S. economy saw a slowdown in growth for much of 2022. Gross domestic product contracted in the first two quarters of the year after advancing at an annualized rate of 5.9% in 2021. But GDP rebounded in the third quarter, climbing 3.2%. Although inflation has cut into consumers' purchasing power, they have continued to spend during difficult economic times, supported by rising wages, job growth, and perhaps access to savings accumulated during the pandemic.

Industrial production lagged through the summer months, only to rebound during the latter part of 2022, ultimately exceeding its pace from a year earlier. The housing sector was hit particularly hard by rising mortgage rates and diminished inventory. Existing home sales were more than 35% below their pace in 2021, while sales of new single-family homes lagged by more than 15%. This might be a good time to mention that one of our partners bought a home in 1975 with a mortgage interest rate of 12.75%. Things could be a lot worse.

Inflation also impacted the stock market, both at home and abroad. Several market sectors that had led the bull surge since 2008 suffered notable pullbacks. After many, many years of out-performance, information technology and communication services ended up as two of the worst performing sectors in 2022. Retail stocks also took a tumble as inflation drove up nondiscretionary items like food and energy, leaving less for consumers to spend on discretionary products and services. Also plaguing retailers were rising costs associated with products, services, and labor.

This past year was not only a difficult one for stocks and bonds, but also for "alternative assets" such as crypto. Rising interest rates impacted the viability of crypto. Couple this with revelations of fraud and abuse, and crypto assets have fallen precipitously. 2022 gave us almost no place to hide.

Nevertheless, as 2022 drew to a close, there were some positives to consider entering the new year. The GDP expanded for the first time in the third quarter, and crude oil and gas prices reversed course and dipped lower. Whew! Primary inflationary indicators, such as the consumer price index and the personal consumption expenditures price index, trended lower at the end of the year. Ultimately, the economic outlook for 2023 will likely depend on the path of inflation and whether the economies of the U.S. and the world can avoid a recession as prices are driven lower.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Snapshot 2022

The Markets

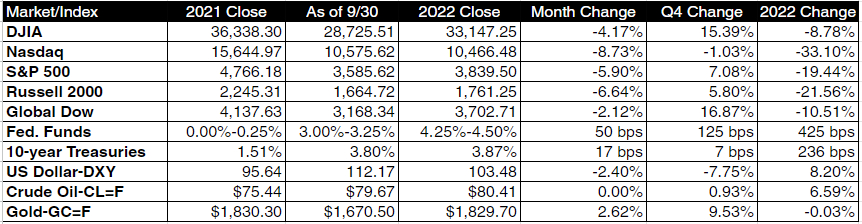

Equitties: Stocks began 2022 on a sour note, ending January and February in the red. Unfortunately, things didn't get much better for the remainder of the year. Following a bull market that lasted more than 10 years, stocks experienced a sizeable pullback. The benchmark indexes listed here declined in each of the first three quarters of 2022. The Nasdaq lost more than 33% on the year, negatively impacted by the Federal Reserve's aggressive, inflation-fighting policy, which hampered tech and growth stocks. While Wall Street showed some resilience in the fourth quarter, stocks suffered their worst year since the financial crisis of 2008.

On the last day of the year, each of the benchmark indexes listed here ended the year lower, despite a solid fourth quarter. Among the market sectors, only energy advanced, gaining a robust 59.04%. The remaining market sectors lost value, led by communication services (-40.4%) and followed by consumer discretionary (-37.6%), information technology (-28.9%), real estate (-28.5%), materials (-14.1%), financials (-12.4%), industrials (-7.1%), health care (-3.6%), consumer staples (-3.2%), and utilities (-1.4%). Like we said earlier, no place to hide.

Bonds: Historically, when stocks are down investors move to bonds. However, for most investors that paradigm did not hold true in 2022, as both stocks and bonds suffered double-digit losses. The Bloomberg Aggregate Bond Index realized the worst return in its history after declining nearly 13%. The yield on 10-year Treasuries rose by more than 2.3%, as bond prices sank, understanding that bond prices and yields move in opposite directions.

The U.S. Treasury yield curve (the difference between short-term bond interest rates and long-term rates) has been inverted for much of the year. Currently, the difference between the 3-month bond and the 10-year bond is roughly -0.65%, indicating an inverted yield curve. Historically, an inverted yield curve has often signaled a recession. Thankfully, other economic indicators seem to indicate that a full-blown recession is unlikely.

Oil: Crude oil prices rode a wave of volatility throughout 2022. An energy crisis, rising demand, and the Russian invasion of Ukraine sent prices soaring, hitting a high of more than $122 per barrel in early June. Then demand waned, particularly in China, where COVID-related lockdowns stifled requirements for crude oil. Crude oil prices were also driven lower by additional U.S. output, including the release of crude oil from the Strategic Petroleum Reserve. By the end of the year, crude oil prices rose by about 7%.

Prices at the pump climbed higher to begin the year, causing a good bit of outrage all around. But as crude oil prices declined, so did retail gasoline prices. The national average retail price for regular gasoline was $3.281 per gallon to begin 2022. Gas prices steadily increased throughout the first half of the year, reaching a high of $5.006 in June. Prices then trended lower for the remainder of 2022, closing out the year at $3.091 per gallon for the week ended December 26. Full disclosure: you might have found these prices in Wisconsin but not in California.

FOMC/interest rates: The target range for the federal funds rate began the year at 0% to 0.25% and ended 2022 at 4.25% to 4.50%, an increase of 4.25%. Inflation began to climb in 2021, as strong consumer demand collided with pandemic-related supply constraints, which drove prices up, reaching a 39-year high in November 2021. The Fed initially termed the rapid rise in prices "transitory," expecting that the factors driving inflation upward would subside.

Unfortunately, inflationary pressures did just the opposite for much of 2022, particularly following the Russian invasion of Ukraine in February. Trying to combat rising inflation, the Fed began hiking the federal funds target range. The first rate-hike came in March at a quarter of a percent, followed by four consecutive three-quarter point interest-rate increases. At its last meeting of 2022 in December, the Fed announced an additional half a percent rate hike.

The Fed’s goal is a soft landing for the economy. They want to raise interest rates just enough to soften the job market, which would lead to slower wage growth, helping to lower inflation, which should allow the positive growth of the economy to continue. But that is not an easy task. The Fed does not want to overtighten because that would mean they would have to cut interest rates soon. Instead, the Fed needs the time to figure out and adjust interest rates to find the “Goldilocks” level to help ensure a continuation of economic growth without a recession.

Gold: Gold prices began the year at $1,830.30 and closed 2022 at $1,829.70, a decrease of about 0.3%. During the first quarter of 2022, gold prices spiked to $2,053 per ounce, following the start of the Russia/Ukraine war. However, by the end of the first quarter, gold prices settled in the $1,930 per ounce range. By the third quarter, weakness in the stock market coupled with a surging dollar sent gold prices down to a 30-month low of $1,691 per ounce. For the remainder of the year, gold prices hovered between $1,750.00 and $1,800.00 per ounce.

Eye on the Year Ahead

The battle against rising inflation will likely continue to dominate much of the economy and stock market in 2023. If and when the Federal Reserve scales back its aggressive interest-rate hikes, investors might be more inclined to return to equities, particularly hard hit tech shares. However, the war in Ukraine and new COVID cases will also have an impact. If nothing else, 2023 should be very interesting.

This may not be our most positive newsletter ever but, again, we will not sugarcoat the potential plusses or minuses of this equity and bond market? You may ask, “Why are we focusing on the some of the worst possibilities?” Because that's when emotions most easily overwhelm any promises to oneself that thou shalt not sell. Breaking that promise likely means locking in miserable returns. Being an investor means never standing still or reaching the end. "Winning" means surviving and surviving means never getting carried away by fads or fears.

We are here. We know the times are challenging – they are for all of us. But decades of experience in the financial world in both bull and bear markets has taught us time and time again that in times like these, patience is not only a virtue but it can be your friend. Perhaps this would be a good time to make it your “word” for 2023.